Table of Content

If you don’t have a lot of cash saved and you are a veteran or looking for a home a bit outside of the city, then you may qualify for no-down payment loans, such as a VA or USDA loan. VA loans also offer even more benefits, like better interest rates and less strident qualifications — but as the name indicates, they are only available to current military members or veterans . Buying a home can be overwhelming no matter what, and if it’s your first time buying, there is a lot to know.

From how much you need for down payments to credit scores, let’s break it down. Put out some feelers with your friends, family, and business contacts. You never know where a good reference or lead on a home might come from. At this point, it’s a good idea to get mortgage offers from multiple lenders.

First-time homebuyer guide: 10 steps to get you started

Be aware that privacy and security policies may differ from those practiced by GAFCU. As the buyer, you get to choose if you’d still like to purchase the home given the report’s findings. A home inspection provides insight into the current condition of a home and its features. Home inspections aren’t required, but highly recommended and are often a contingency in your contract. You’ll complete other closing processes during this phase, too. House hunting is an exciting time to explore properties until you find your dream home.

Homeownership is something you’d like for your future, and knowing the timeline for buying a house will help guide you. You may qualify for an FHA loan if you have a deposit of 10%. You may work in conjunction with down payment programs for further assistance here. Finding a co-signer is the answer to how to buy a house with no money and bad credit.

What Affects Your Score?

If the seller isn’t willing to negotiate, your mortgage lender is unlikely to approve the mortgage for a higher amount than the home’s worth. At this point, you can walk away from the deal or pay the difference between the appraised value and the purchase price. It’s key to get a real estate agent that represents you, instead of a dual agent that represents the seller, too. This home buyer mistake can prevent both the buyer and seller from having fair representation. A mortgage pre-approval shows you how much home you qualify for.

Speak to a housing counseling agency to learn about your options. Wondering how to buy a house with bad credit but good income? Your mortgage repayments should account for 35% of your salary or less.

How to Buy a House With Bad Credit

Some consumer financial experts suggest that the average yearly maintenance will amount to about 1.5% of the home’s market value. Mortgage insurance helps protect the lender in case you default on the loan. Other home buying programs exist for public servants like teachers, firefighters, doctors, and other first responders.

You don’t have to buy next month, but the longer you plan and prepare, the sooner you can be ready to buy with more options. Tune in to this episode and learn the best way to navigate the current real estate climate. Approved lenders should be able to tell you if you qualify or not. Your credit score and down payment have a significant impact on your eligibility. There are, however, a few other factors that mortgage lenders consider. Alternatively, take a look at the lenders who offer personal loans for bad credit, you may have a chance.

Speak to a Housing Counseling Agency

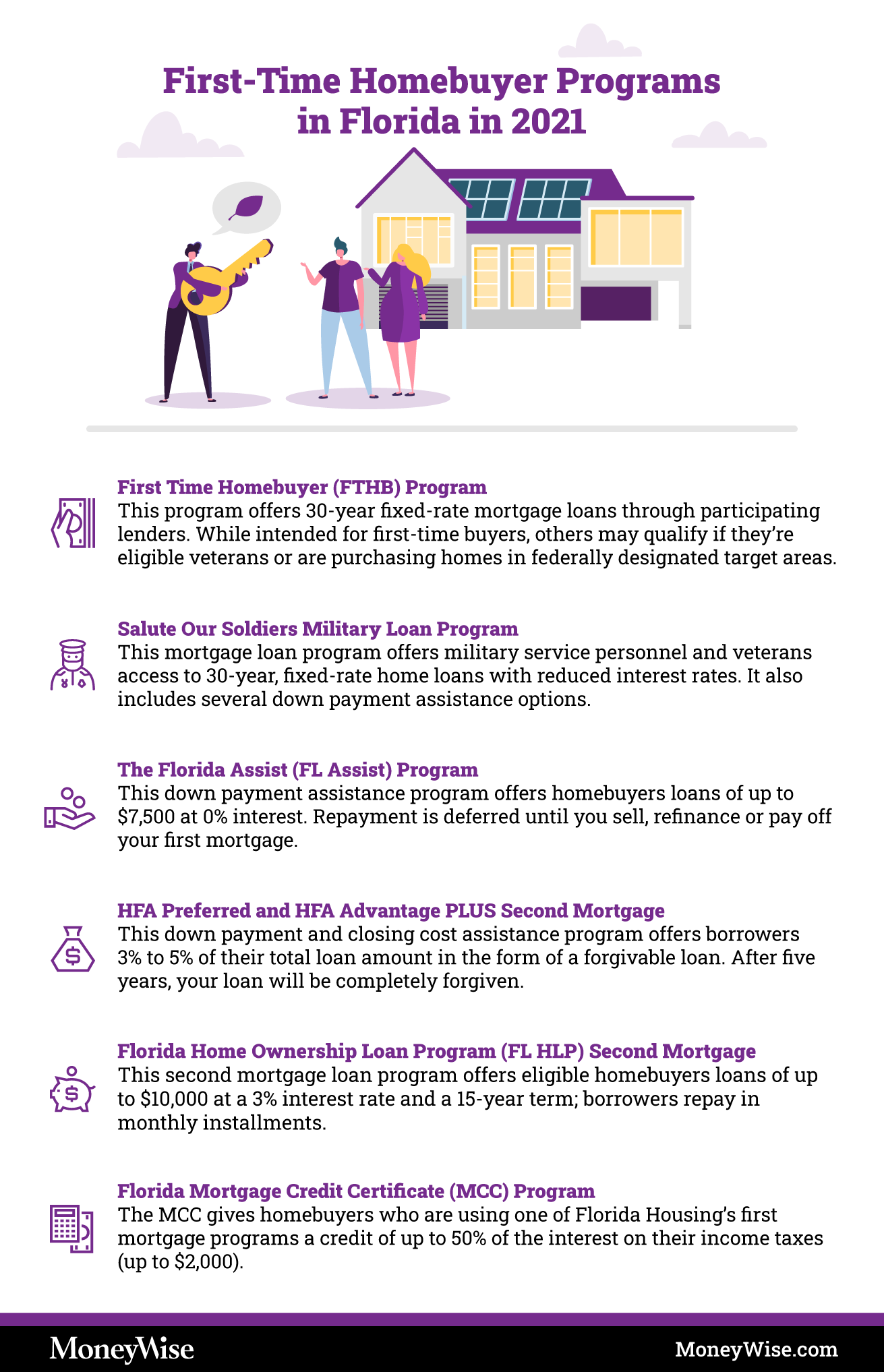

The best way to determine if you’re eligible for a first-time home buyer program is to reach out to the housing authority in the town or city where you want to purchase a home. “Every state in the country has a housing finance agency, and all offer special programs for first-time buyers,” says Anna DeSimone, author of Housing Finance 2020. For example, you might be able to qualify for an FHA loan with a credit score as low as 500, as long as you can make a 10% down payment. You might even be in line for a grant to help with your down payment and closing costs.

Don’t forget to do your research and ask plenty of questions when talking to lenders and your real estate agent about local and state first-time buyer programs. Many offer down payment grants, no-down-payment mortgages, and low interest rates. Before you start shopping, it’s important to get an idea of how much a lender will give you to purchase your first home. In addition, many real estate agents will not spend time with clients who haven’t clarified how much they can afford to spend.

It is entirely possible that you will be asked to pay a portion, or all, of the closing costs for the purchase of your home. Your mortgage lender can provide you with an estimate of the closing costs and explain each item to you. Depending on credit scores, loan program, and other factors, some borrowers could be asked to pay as much as 20% down payment in order to secure financing.

But neither of these methods takes into account any other debts or ongoing expenses you may have. Keep in mind that homeownership costs more than just your monthly mortgage payment. You’ll also need to factor in the costs of moving expenses, utilities and maintenance, as well as closing costs and your down payment. How much do I have saved for a down payment and closing costs? With most mortgages, you’ll need to pay a percentage of the home price upfront — usually at least a few thousand dollars.

And credit requirements may be subject to change from time to time, as we saw at the height of the Covid pandemic. That’s especially good news for “boomerang buyers” who owned a home in the past but went through a short sale, foreclosure, or bankruptcy. Judy Dutton is executive editor at Realtor.com covering news and advice about personal finance, homebuying, selling, decorating, and all things real estate. When loan environments are riskier , it can be harder to get these kinds of loans. You may have a preapproval, but a preapproval does not guarantee formal loan approval. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence.

Many of these come through state housing finance agencies, which you can find through the National Council of State Housing Agencies. Loan amount — You’ve already determined what monthly payment you can afford, so you’ll want to find a lender that can offer you the mortgage that fits it. These are issued by private lenders and aren’t part of a government program. Conventional loans tend to cost less than other options but can be more difficult to qualify for. Take a close look at your monthly income and expenditures, and evaluate how much you can reasonably afford to spend on your new home. Just because you might be able to qualify for a mortgage of a certain amount, doesn’t mean you can comfortably afford the monthly payments on it.

A score in the 700s or above is considered “excellent” and will likely secure a loan with the most favorable interest rate. Meeting credit score requirements is a must to qualify for no-down-payment or low-down-payment loans for first-time buyers. In deciding how big a loan to actually take, you’ll want to look at the house’s total cost, not just the monthly payment. All these will go to the loan underwriters, who will determine if you qualify for the loan. In the meantime, you’ll get a Loan Estimate within three days of completing a mortgage application. The Loan Estimate will include the interest rate, expected closing costs and monthly payment for the mortgage.

No comments:

Post a Comment